This list of key terms includes many commonly used terms but is not a full list. These terms and definitions are intended to be educational.

Medical / Pharmacy Plan Options

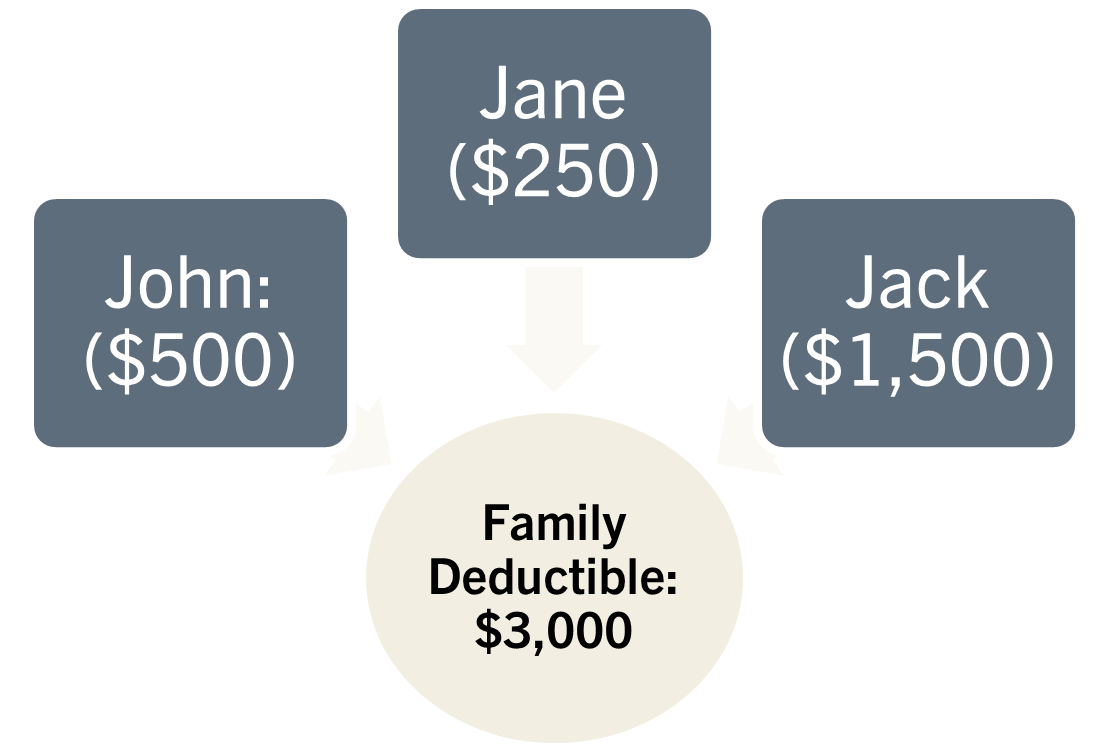

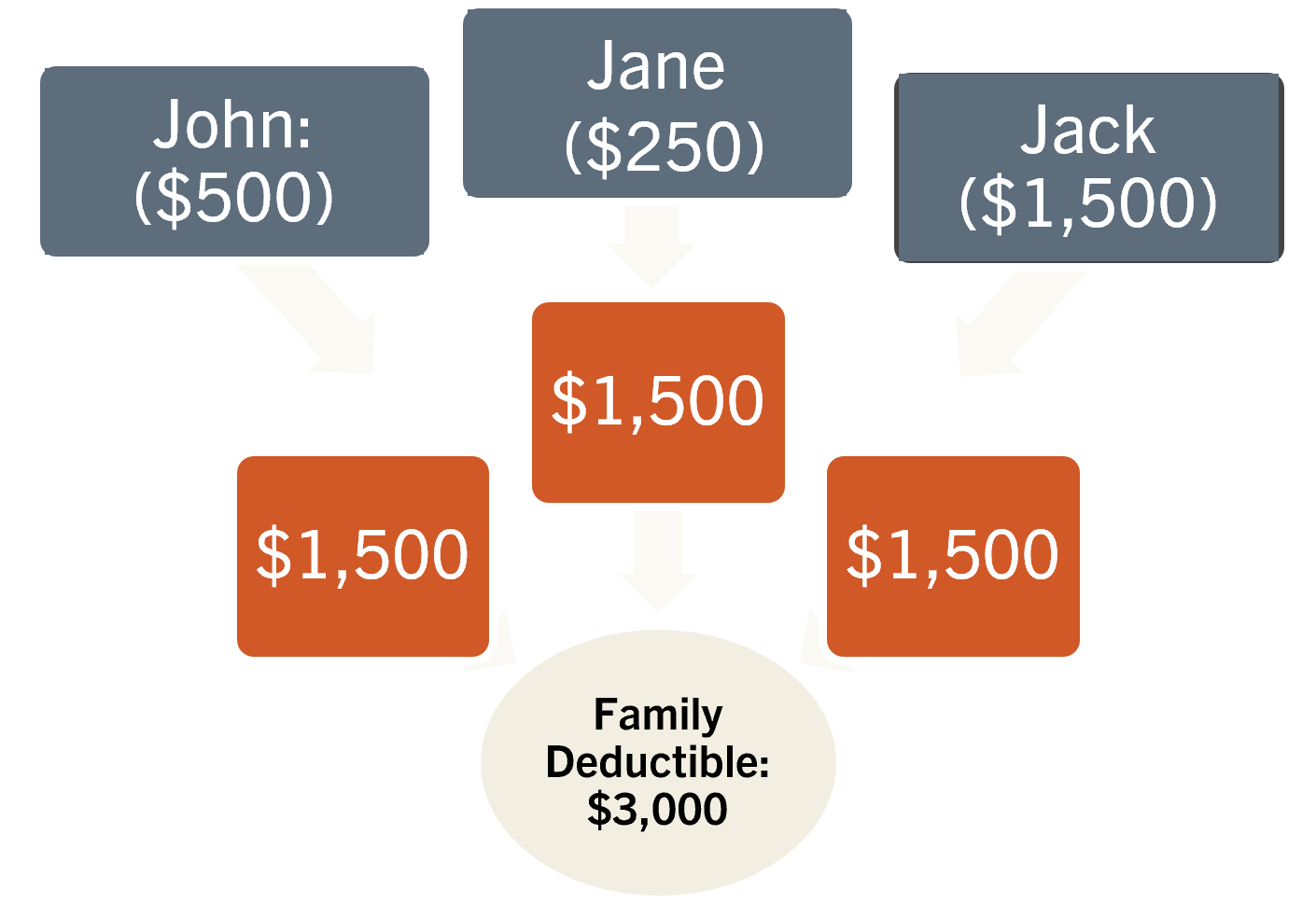

Deductibles: Aggregate vs. Embedded Examples

Sample Plan

Individual Deductible: $1,500

Family Deductible: $3,000

Aggregate Family Deductible

With an aggregate family deductible, your family will be paying the deductible until the entire family deductible is collected. The HSA plan has an aggregate deductible.

Jack falls, sprains his wrist and needs to go to the emergency room. Will the coinsurance kick in immediately since he has already met the $1,500 individual deductible?

No, Jack (and all family member) will continue to pay the full cost of treatment until the $3,000 family deductible is met.

Embedded Family Deductible

With an embedded family deductible, the plan begins to make payments as soon as one member of the family reaches their individual deductible. The OAPIN, OAP, and Low HSA plans have embedded deductibles.

Jack falls, sprains his wrist and needs to go to the emergency room. Will the coinsurance kick in immediately since he has already met the $1,500 individual deductible?

Yes, however, other family members will continue to pay until each of their individual $1,500 deductible is met OR the family deductible of $3,000 is met.