Flexible Spending Accounts (FSAs)

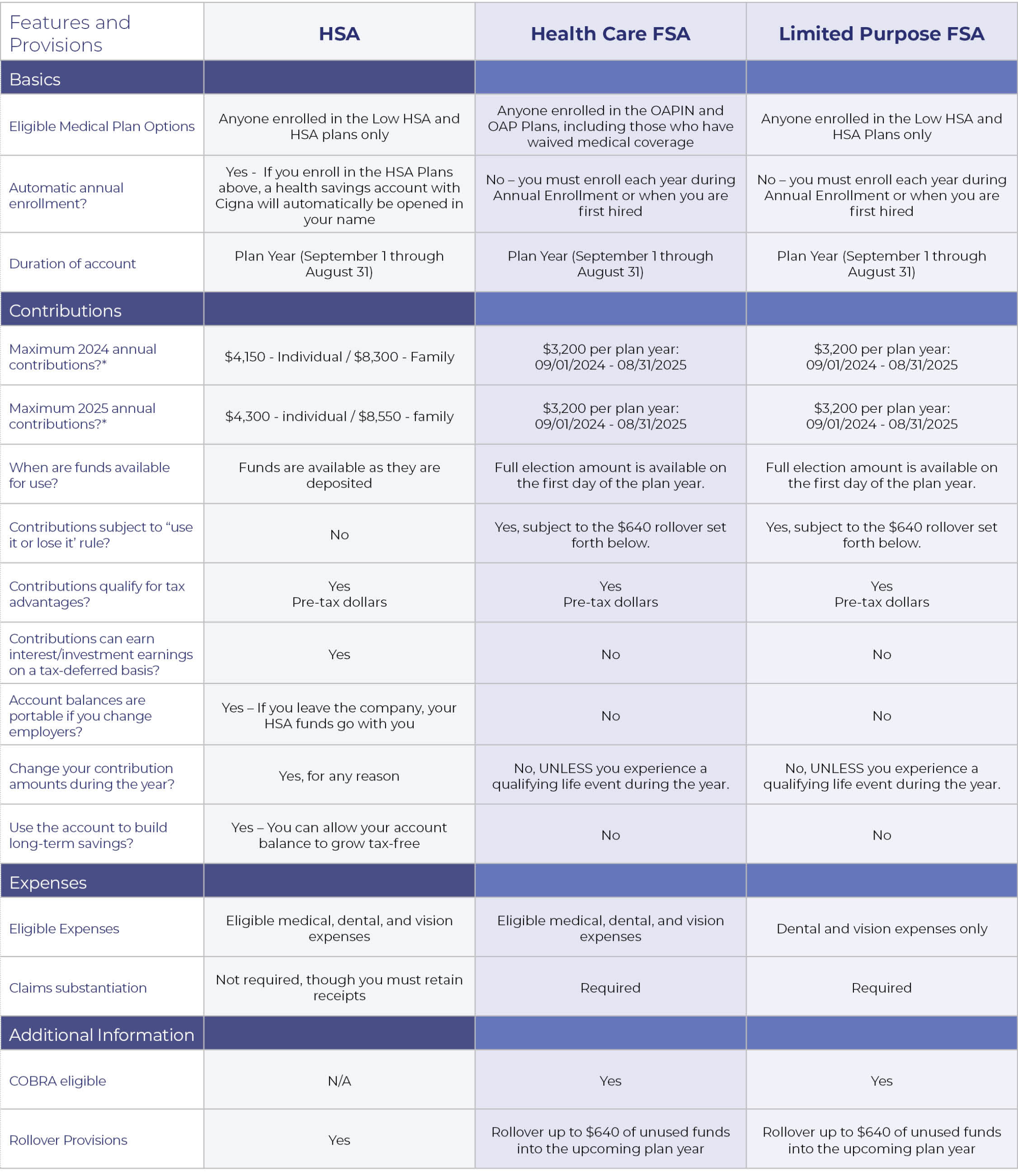

Inserso’s Flexible Spending Accounts (FSAs) let you set aside pre-tax dollars out of your paycheck to pay for certain non-reimbursable expenses. The end result, you pay less taxes. Plus, the convenience of automatic payroll deductions makes it easy to participate.

New hires will be able to enroll into the Health Care and Dependent Care FSA during their new hire enrollment period.

Budget Appropriately

FSAs are typically “use or lose” programs. This means if you do not use all of the funds you elect to contribute to your FSA during the calendar year, you will lose those remaining funds (with exception of rollover amounts outlined below). The only time you may make a change to your Health Care/Limited Purpose and/or Dependent FSA contribution election is if you experience an IRS Qualifying Life Event (QLE) such as marriage, birth of a child, adoption of a child, divorce, widowed, etc.

Save All Receipts

You must save all receipts from purchases made on your FSA Benny Card, including prescriptions and physician copays. Sentinel may request that you substantiate your FSA purchases made on the Benny Card.

Important: The FSA is Based on Plan Year

The FSAs run on a Plan Year basis; that is, from September 1 through August 31.

Please note:

If you have a Health Care FSA and enroll in one of the QHDHP medical plans for the new plan year, you will be able to contribute to an HSA effective 9/1. If you have remaining funds in your Health Care FSA as of August 31, you have two options:

- You can do nothing. Your FSA plan will end as of 8/31, and you will forfeit any remaining funds for expenses that were incurred in the plan year if you have not submitted for reimbursement for such expenses within 90 days of 8/31; or

- Transition your remaining Health Care FSA funds, up to the IRS rollover amount, into a Limited Purpose FSA, effective 9/1, by signing up for a Limited Purpose FSA during open enrollment. Any funds in excess of the rollover amount would be forfeited.